Director Remuneration

Matters Relating to the Policy for Determining the Amount of Remuneration for Directors and the Method of Calculating That

We stipulate the following matters relating to the policy for determining the amount of remuneration for Directors and the method of calculating that.

- a. Remuneration for Directors (Excluding Directors Who Also Serve as Audit and Supervisory Committee Members)

- We have introduced a performance-linked remuneration plans for Directors (excluding Outside Directors). The purpose of these plans is to raise the awareness of Directors to contribute to improving the medium- to long-term performance and to increasing the corporate value. The plans aim to achieve this by further clarifying the linkage between the remuneration for Directors and the performance and stock price and by allowing Directors to share the benefits and risks from fluctuations in the stock price with the shareholders.

- Basic Policy

-

- Establish a remuneration structure to share value with shareholders and other stakeholders.

- Establish a remuneration structure that raises awareness to improve mid- to long-term performance and to increase corporate value.

In terms of the method for determining the amount of remuneration for Directors and the method of calculating that in the fiscal year as of the date of the submission of the Annual Securities Report, the Board of Directors determines the remuneration for Directors within the range of the total amount approved at the General Meeting of Shareholders. It determines this upon consulting with and making a report to the Nomination and Compensation Advisory Committee for which Outside Directors account for the majority of its members. The Nomination and Compensation Advisory Committee deliberates on matters relating to the total amount of remuneration to be paid to Directors, matters relating to the method of calculating the amount of remuneration and matters relating to the performance-linked coefficients. It then reports its findings to the Board of Directors.

- Remuneration Structure

-

The renumeration structure for directors (excluding Outside Directors, Directors who also serve as Audit and Supervisory Committee Members) consists of basic renumeration (fixed renumeration based on position), performance-linked cash remuneration (bonus), and performance-linked share-based Remuneration (Board Benefit Trust).

Amounts of remunerations for directors are reported to the Board of Directors upon deliberations by the Nomination and Compensation Advisory Committee taking into account benchmarking of companies in the same industry and business size as the company as a peer group as the company based on director remuneration survey data by expert external institutions.

In light of their roles and to ensure objectivity, renumeration to Outside Directors includes basic renumeration (fixed renumeration) only.

(i) The amount of remuneration determined according to role is paid as monthly remuneration for the basic remuneration (fixed remuneration).

(ii) Performance-linked cash renumeration (bonuses) is designed to set consolidated operating profit as a KPI as the company's performance for a single fiscal year and the renumeration amount is paid out at a rate between 0% and 200% based on level of achievement.

(iii) We set the annual targets of EPS (consolidated net income per share) and ROE (consolidated return on equity) outlined in the Mid-Term Management Plan as KPIs with stock renumeration paying out between 0% and 200% based on the level of achievement for performance-linked nonpecuniary renumeration (Board Benefit Trust). Furthermore, the vesting to Directors is the time of retirement from the position of Director. This serves as a medium- to long-term incentive in which the value of assets fluctuates as the stock price fluctuates during the terms of office of those Directors.

The renumeration structure is designed so that ratio of performance-linked renumeration increases as performance and corporate value improves with a goal of each renumeration type being equally distributed between basic renumeration, bonus, and stock renumeration over time.

We have introduced the Business Execution Evaluation-linked Monetary Renumeration which paid out between 0% and 200% according to individual performance to Strategic Goals since FY2022 separate to the above remuneration for managing and executive officers (excluding the President and Representative Director).

(Performance-linked Cash Remuneration in FY2023:KPI Performance)

KPI FY2023

TargetFY2023

ActualPerformance-linked

CoefficientCash renumeration

(bonuses)Consolidated operating profit 16.5

billion yen18.213

billion yen1.21 share-based

Remuneration

(Board Benefit Trust)EPS

(consolidated net income per share)186.12 yen 75.90 yen 0.21 ROE

(consolidated return on equity)More than

5%3.0% 0.19 (note) - (Note) Since the consolidated ROE is less than 5%, the calculated performance-linked coefficient reflects a 10% reduction.

(Reasons for KPI selection)

KPI Reasons for selection Cash renumeration

(bonuses)Consolidated operating profit Linked with annual KPIs for continuous corporate performance and financial value improvement share-based Remuneration

(Board Benefit Trust)EPS

(consolidated net income per share)Linked with Mid-Term Management Plan KPIs for an expansion in results and an improvement in corporate value in the medium- to long-term ROE

(consolidated return on equity) - b.Remuneration System for Directors who also serve as Audit and Supervisory Committee Members

- In light of their roles and to ensure objectivity, renumeration to Directors who also serve as Audit and Supervisory Committee Members is comprised of basic renumeration only. Renumeration amounts are determined based on deliberation in the audit and supervisory committee up to a maximum renumeration amount for Directors who also serve as Audit and Supervisory Committee Members s determined via a resolution by the General Meeting of Shareholders. Furthermore, we reference survey data by expert external institutions when determining renumeration levels for Directors who also serve as Audit and Supervisory Committee Members.

Total Amount of Remuneration by Position, Total Amount by Type of Remuneration, and Number of Eligible Recipients

| Position | Number of eligible recipients (persons) |

Total amount by type of remuneration (millions of yen) | Total amount of remuneration (millions of yen) |

|||

|---|---|---|---|---|---|---|

| Fixed remuneration |

Performance-linked remuneration | |||||

| Cash remuneration (bonuses) |

Share-based remuneration (Board Benefit Trust) |

Business execution evaluation-linked monetary renumeration (individual bonuses) (Individual Bonuses) |

||||

| Directors (excluding outside directors and Audit and Supervisory Committee Members) |

4 | 118 | 27 | 8 | 4 | 159 |

| Audit and Supervisory Committee Members (excluding outside directors) |

1 | 27 | - | - | - | 27 |

| Outside directors | 9 | 70 | - | - | - | 70 |

| Total | 14 | 216 | 27 | 8 | 4 | 257 |

(Note)

- 1

- The above number of eligible recipients includes two directors who resigned upon the conclusion of the 95th Ordinary General Meeting of Shareholders held on June 28, 2023.

- 2

- The total amount of remuneration of directors excludes the portion of employee remuneration for directors who concurrently serve as employees.

- 3

- At the 94th Ordinary General Meeting of Shareholders held on June 21, 2022, the amount of remuneration for directors was determined to be no more than ¥600 million per year (of which, the amount of remuneration for outside directors was to be no more than ¥100 million per year) before the transition to a company with an Audit and Supervisory Committee. Meanwhile, the maximum amount of remuneration for directors (excluding outside directors) includes director bonuses and does not include the portion of employee remuneration. The number of directors as of the conclusion of the 92nd Ordinary General Meeting of Shareholders was nine (of whom, five were outside directors).

- 4

- The above includes performance-linked cash remuneration (bonuses) for this fiscal year.

- 5

- We have introduced the Performance-linked Share-based Remuneration Plan (Board Benefit Trust) for Directors (excluding Directors who are Audit and Supervisory Board members and Outside Directors) as a nonpecuniary remuneration.

- 6

- At the 94th Ordinary General Meeting of Shareholders held on June 21, 2022, the amount of contributions that can be made in the form of funds to acquire the Company’s shares necessary for issuance to directors eligible for performance-linked remuneration (Board Benefit Trust) during the three-year period which can be extended within the five business year at the necessary time in accordance with the determination by the Board of Directors was determined to be no more than ¥600 million per year. The number of directors (excluding outside directors, and directors who also serve as Audit and Supervisory Committee Members) as of the conclusion of the 94th Ordinary General Meeting of Shareholders was four.

- 7

- Amount of performance-linked remuneration (Board Benefit Trust) explains the recording expense in the fiscal year under the Performance-linked Share-based Remuneration Plan determined at the 94th Ordinary General Meeting of Shareholders held on June 21, 2022.

- 8

- At the 94th Ordinary General Meeting of Shareholders, the maximum amount of remuneration for Audit and Supervisory Committee members was determined to be no more than ¥100 million per year. The number of Audit and Supervisory Committee members as of the conclusion of the 94th Ordinary General Meeting of Shareholders was three.

Director Remuneration System for fiscal 2024

Three Directors will be eligible for the Director performance-linked remuneration program in FY2024.

- (Performance-linked Remuneration for Directors)

- The following gives an overview of the details of the variable remuneration for Directors – performance-linked cash remuneration (bonuses) and performance-linked share-based Remuneration.

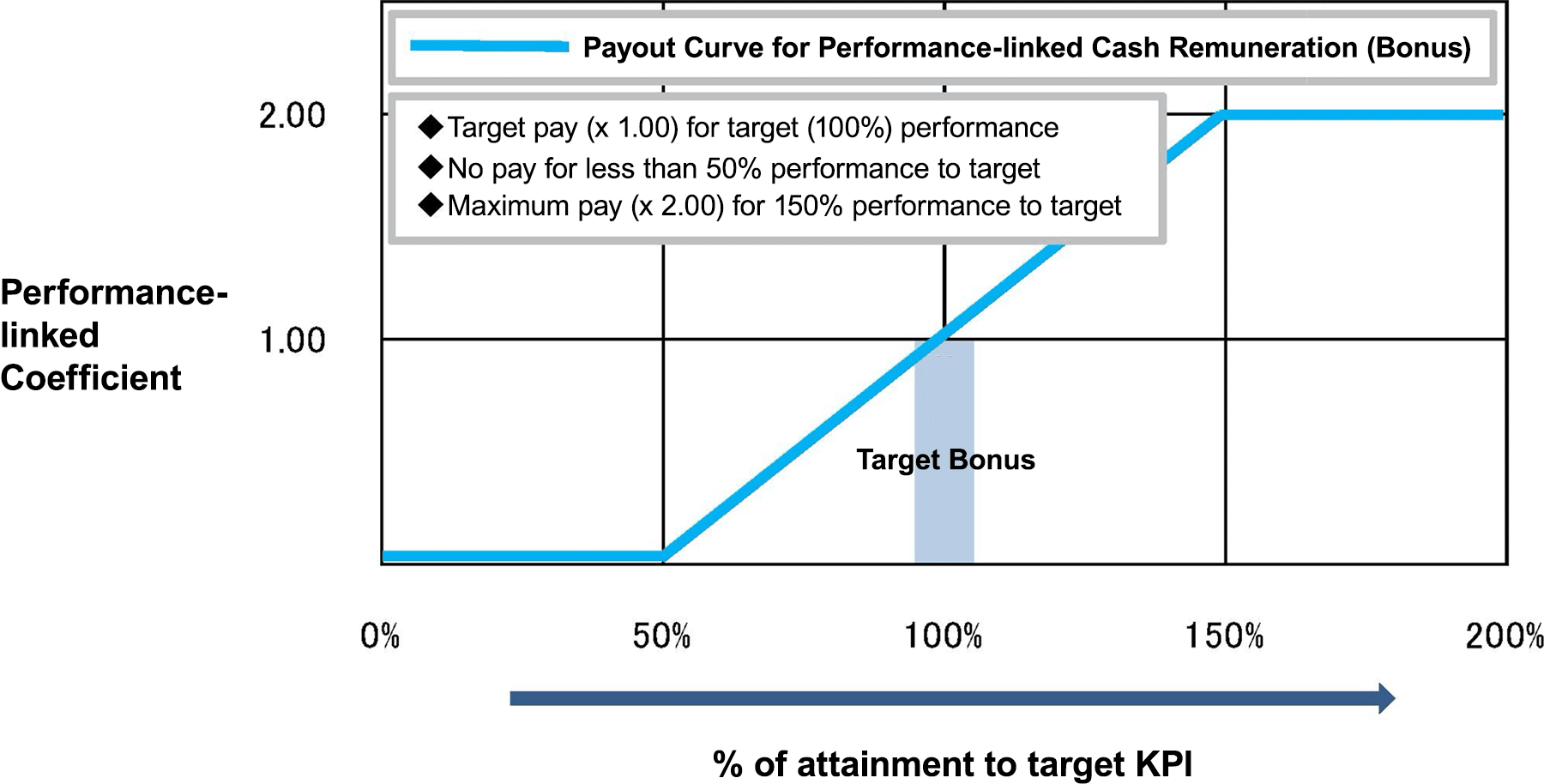

- a. Performance-linked Cash Remuneration (Bonuses)

-

We have adopted consolidated operating profit as the single-year performance-linked indicator (hereinafter referred to as “KPI”) for performance-linked cash remuneration (bonuses). This is to raise awareness of improving corporate performance each fiscal year. We calculate the amount to be paid according to the achievement level with respect to the KPI. We determine the amount of remuneration for performance-linked cash remuneration (bonuses) based on performance in the applicable fiscal year. We then pay that in the next fiscal year. Accordingly, FY2025 will see us pay the amount of remuneration determined based on performance in FY2024. There is an upper limit of 200 million yen as the total amount that can be paid in one fiscal year. We determine the individual amount of payment to each director according to the following formula.

Individual amount of payment = Target amount of remuneration by position (i) × performance-linked coefficient (ii)

- (i) Target amount of remuneration by position

-

We will set the consolidated operating profit of 20.0 billion yen as the target KPI in FY2024. The target amount of remuneration when the target KPI is achieved 100% is as follows.

Position Target Remuneration (million yen) Eligible directors (persons) President and

Representative Director16.0 1 Directors (Senior) 8.0 2 Directors 6.4 0 As for the directors (senior), Mr. Hiroyuki Tanaka, and Mr. Sunao Maeda, fall under this category.

- (ii) Performance-linked coefficient

-

(Performance-linked Coefficient Calculation Method)

KPI achievement rate Performance-linked coefficient 150% or over 2.0 50% or over but less than 150% (Actual KPI ÷ Target KPI – 0.5) × 2

(Round up to two decimal places)Less than 50% 0 - KPI achievement rate = Actual KPI ÷ Target KPI × 100

- Actual KPI = Actual amount of operating profit in the applicable fiscal year

- Target KPI = Target amount of operating profit in the applicable fiscal year

[Image of Payout Curve in Performance-linked Coefficients]

The limit of individual payments to Directors is as follows.

President and Representative Director 50 million yen

Directors (Senior) 25 million yen

Directors 20 million yen - (iii) Handling If Directors Are Newly Appointed during the Applicable Period

-

We shall pay Directors who are newly appointed during the applicable period the individual amount of payment to Directors proportionally divided by the number of months they serve in office. If a Director is newly appointed partway through a month, we shall calculate the payment as though the said Director has been in office for the full month.

Proportional ratio = Total number of months served in office during the applicable period ÷ Total number of months of the applicable period

- (iv) Handling If Directors Retire (Including If They Die) during the Applicable Period

-

We shall pay the payment to Directors who retire (including those who die) during the evaluation period by proportionally dividing by the number of months they serve in office the amount obtained by multiplying by 80% the target amount of remuneration for Directors. If a Director retires partway through a month, we shall calculate the payment as though the said Director has been in office for the full month. However, if a Director is dismissed based on disciplinary action due to misconduct, the payment ratio shall be 0%.

Proportional ratio = Total number of months served in office during the applicable period ÷ Total number of months of the applicable period

- (v) Handling If the Position of a Director Changes during the Applicable Period

-

If the position of a Director changes during the applicable period, we shall pay the said Director the individual amount of payment according to his/her position as of the end of the fiscal year (the end of March).

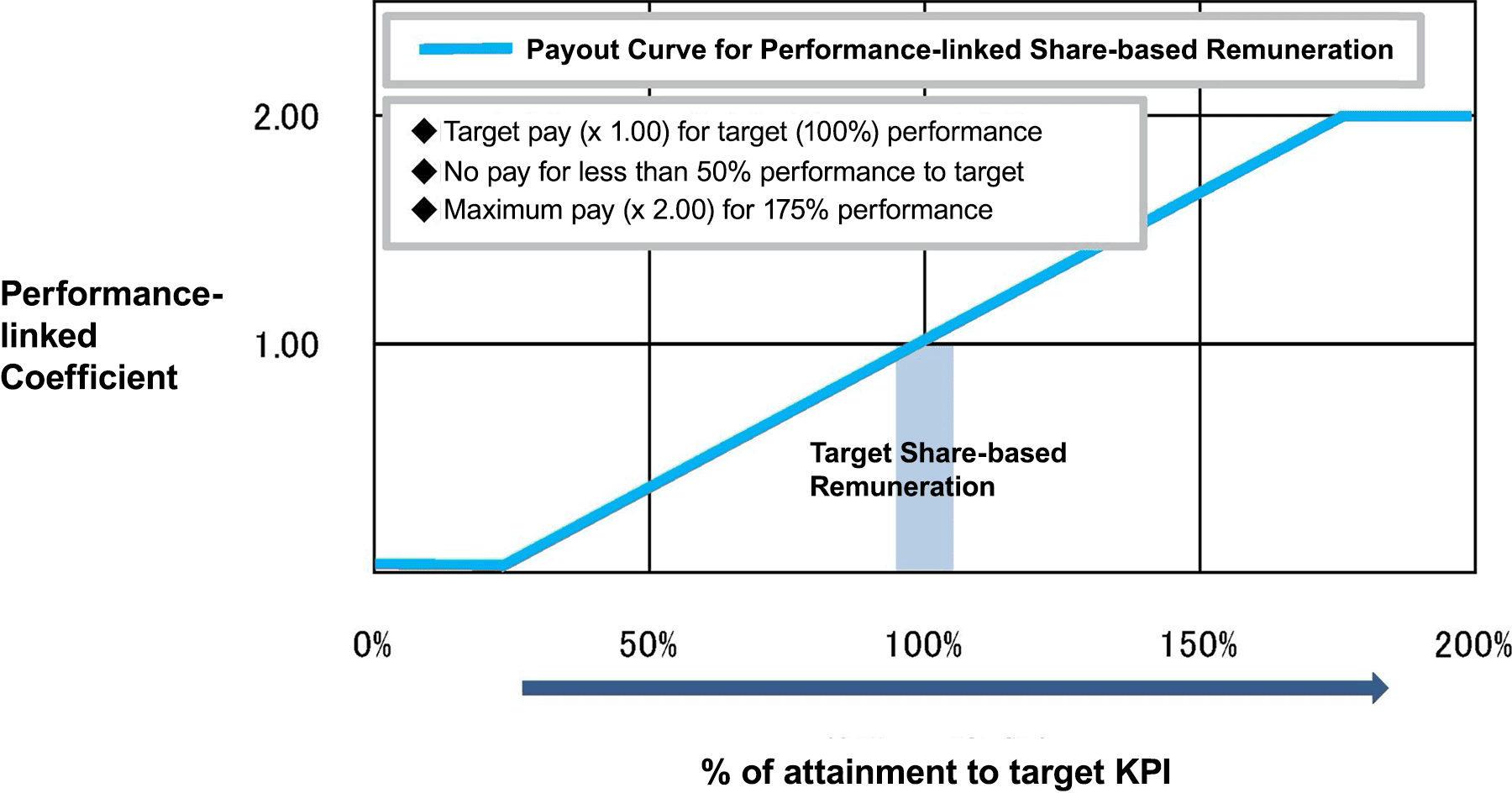

- b.Performance-linked Share-based Remuneration Plan

-

The performance-linked share-based Remuneration system (hereinafter “the System”) further clarifies the linkage between the remuneration of Directors and the performance and stock price of the Company. The objective is to raise awareness to improve mid- to long-term performance and to increase corporate value by directors sharing profits and risks from fluctuations in the share price with shareholders. In addition, we employ single-year EPS (consolidated net income per share) and consolidated ROE as the KPIs to raise awareness of improving corporate performance each fiscal year and to further share value with stakeholders.

The System is a share-based Remuneration system. A trust established by the Company through contribution of money (hereinafter “the Trust”) acquires shares in the Company. The number of shares in the Company equivalent to the number of points awarded by the Company to the directors is then given to the directors through the Trust. One share is given for each point awarded. Moreover, in principle, the period in which directors receive shares in the Company according to the points they have been awarded is up until when they retire as directors. The number of points awarded to directors is determined by the performance (consolidated EPS and consolidated ROE) in one fiscal year. However, the number of points awarded to directors on their retirement is finalized on the performance-linked indicator settlement date in the final fiscal year when they retire.

The upper limit of the money that the Company will contribute to the Trust as the amount to acquire the shares in the Company necessary for the Trust to give them to those concerned is 200 million yen per fiscal year. In addition, the upper limit on the total number of points to be awarded to those eligible for the Trust is 100,000 points per fiscal year. The individual points to be awarded to each Director is determined with the following formula.Individual payment points = Target amount of remuneration by position (i) × Performance-linked coefficient (ii) ÷ Price of shares in the Company acquired by the Trust (iii)

(Rounded up when less than 100 points) - (i) Target amount of remuneration by position

-

The KPI for FY2024 is a consolidated net profit of 116.33 yen per share with the following representing the base renumeration amount for a 100% KPI achievement rate.

Position Base Remuneration (million yen) President and Representative Director 8.1 Directors (Senior) 4.1 Directors 3.3 As for the directors (senior), Mr. Hiroyuki Tanaka, and Mr. Sunao Maeda, fall under this category.

- (ii) Performance-linked coefficient

-

(Performance-linked Coefficient Calculation Method)

KPI achievement rate Performance-linked coefficient 175% or over 2.0 25% or over but less than 175% (Actual KPI ÷ Target KPI – 0.25) × 1.33

(Round up to two decimal places)Less than 25% 0 - KPI achievement rate=Actual KPI÷Target KPI×100

- Actual KPI=Actual consolidated net income per share in the applicable fiscal year

- Target KPI=Target consolidated net income per share in the applicable fiscal year

This is a share-based remuneration system in which the calculated amount of remuneration is reduced by 10% and then paid (reflected in the performance-linked coefficient) when the consolidated ROE is no more than 5%.

[Image of Payout Curve in Performance-linked Coefficients]

The upper limits on the individual payment points (1 point = 1 share) to each director are as follows.

President and Representative Director 25.0 thousand points

Directors (Senior) 12.5 thousand points

Directors 10.0 thousand points - (iii) Price of shares in the Company acquired by the Trust

-

For stock allocated to the Trust, the Board of Directors votes on the acquisition method, number of shares allocated, and allocation price. This information shall be disclosed externally on the same day. While there are two methods of acquiring stock, the disposal of retained treasury stock or acquisition through a stock exchange (including after-hours trading), the price of stock allocated to the Trust will be the following stock price.

For disposal of retained treasury stock:

The final stock price of Company stock on the Tokyo Stock Exchange on the business day immediately prior to Board of Director’s meeting convened to vote on third-party allocation related to this structure (allocation to stock trust).For acquisition through a stock exchange:

The price of Company stock purchased from a stock exchange after a resolution by the Board of Directors concerning the acquisition of stock in relation to this structure.Furthermore, the stock price when calculating points allocated to individual directors shall be calculated based on the average price of retained stock at the time of points allocation by the Trust.

- (iv) Handling If Directors Are Newly Appointed during the Applicable Period

-

We shall grant Directors who are newly appointed during the applicable period the individually granted points to Directors proportionally divided by the number of months they serve in office. If a Director is newly appointed partway through a month, we shall calculate the grant as though the said Director has been in office for the full month.

Proportional ratio = Total number of months served in office during the applicable period ÷ Total number of months of the applicable period

- (v) Handling If Directors Retire (Including If They Die) during the Applicable Period

-

We shall grant the points to Directors who retire (including those who die) during the evaluation period by proportionally dividing by the number of months they serve in office the amount obtained by multiplying by 80% the target amount of remuneration for Directors. If a Director retires partway through a month, we shall calculate the grant as though the said Director has been in office for the full month. However, if a Director is dismissed based on disciplinary action due to misconduct, the grant ratio shall be 0%.

Proportional ratio = Total number of months served in office during the applicable period ÷ Total number of months of the applicable period

- (vi) Handling If the Position of a Director Changes during the Applicable Period

-

If the position of a Director changes during the applicable period, we shall grant the said Director the individually granted points according to his/her position as of the end of the fiscal year (the end of March).

- (vii) Handling of Conversion into Cash

-

In the event that the relevant director, who is a non-resident, resigns or retires due to death, the company shall, in lieu of delivering the company's shares, provide the relevant director or their estate with an amount of money equivalent to the market value of the shares that would have been delivered.

- c.Business Execution Evaluation-linked Monetary Renumeration (Individual Bonuses)

-

Managing and executive officers (excluding President and Representative Director) are responsible for important and strategic business execution in management to achieve performance targets and to improve corporate value. Therefore, we have introduced evaluations relating Strategic Goals to the business execution of individuals since FY2022 to clarify the executive responsibilities and results of individual Directors and to reflect the degree at which performance is demonstrated in their remuneration. After setting concrete indicators and targets for issues in their own departments, which is a priority area in ESG management, in addition to company-wide performance, the performance of the departments they are in charge of and individual priority issues, President and Representative Director will then determine the Strategic Goals evaluation based on the rate at which those are achieved. We have set ESG targets linked to the basic policy "Enhancing Sustainability (Aligning Sustainability strategy with Management strategy)" of the Mid-Term management plan "Reborn 2024 for the Strategic Goals evaluation. We have set the evaluation weight of that to a uniform 10%.

We determine the individual amount of payment to each director according to the following formula.Individual amount of payment = Target amount of remuneration by position (i) × performance-linked coefficient (0 - 0.2)

- (i) Target amount of remuneration by position

-

Position Target remuneration

(million yen)Eligible directors

(persons)Directors (Senior) 2.3 2 Directors 1.8 0 As for the directors (senior), Mr. Hiroyuki Tanaka, and Mr. Sunao Maeda, fall under this category.

- d.Remuneration composition

-

The rates when those performance-linked coefficients are all 1.0 in the FY2024 target KPI are as below.

Position Basic renumeration

(fixed renumeration)Performance-linked

cash remunerationPerformance-linked

share-based Remuneration

(Board Benefit Trust)Performance-linked

cash remuneration

(Individual Bonuses)President and

Representative

Director70% 20% 10% - Directors

(Senior)64% 20% 10% 6% Directors 64% 20% 10% 6%

Corporate Governance

Group Governance