News Release

Financial results

Announcement of the Settlement of Accounts for the Third Quarter of the Year Ending March 2018

2018.2.7

(Note) Figures shown have been rounded down to the nearest million yen

Our settlement of accounts for the Third quarter of the year ending March 2018 was announced on the afternoon of Wednesday, February 7 at the Tokyo Stock Exchange Press Club. An outline of the accounts is presented below.

Consolidated Results for the Third Quarter of the Year Ending March 2018 (April 1, 2017 to December 31, 2017)

Consolidated operating results (total)

(% is in comparison to the previous year)

| Revenue | Operating profit | Ordinary profit | Net income attributable to shareholders of parent company for quarter | |||||

|---|---|---|---|---|---|---|---|---|

| (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | |

| Third quarter of the year ending March 2018 | 230,409 | 5.5 | 15,822 | 1.2 | 15,588 | (0.9) | 11,070 | (3.4) |

| Third quarter of the year ending March 2017 | 218,372 | 1.8 | 15,638 | 24.5 | 15,730 | 52.1 | 11,461 | 79.4 |

- *Comprehensive income:

-

- 3Q for year ending March 2018: 12,170 million yen (147.6%)

- 3Q for year ending March 2017: 4,915 million yen (-%)

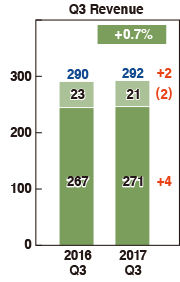

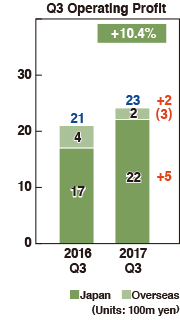

Segment-specific summary

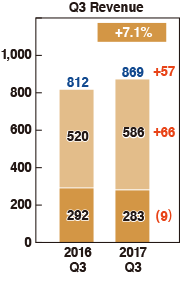

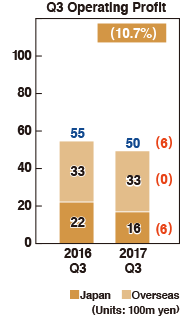

Oils and Fats

Japan

A focus on sales of profitable products such as frying oil resulted in decreased revenues. Income declined due to a decline in profitability caused by higher raw material prices.

Overseas

Revenues increased thanks to firm sales of hard butters for chocolate, etc., in the Americas and in Europe. Income declined due to a decline in profitability caused by higher raw material prices.

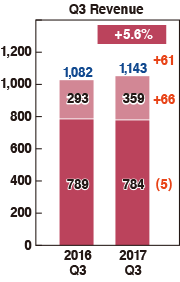

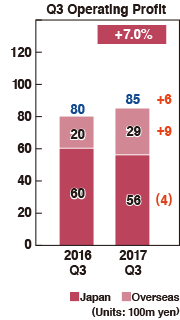

Confectionery and Bakery Ingredients

Japan

Although sales of vegetable-based cream products grew, revenues declined on decreased sales of chocolate for frozen confectioneries resulting from unusual weather and a continued focus on profitable sales of food ingredients.

Overseas

Revenues increased thanks to favorable sales of filling products on the China market, and increased in Asia and Brazil.

Income increased mainly due to higher profits in Brazil and Asia.

Soy

Soy protein materials

Sales for the cereal and health food markets were favorable.

Soy protein functional agents

Revenues and income increased thanks to firm sales of drink ingredients.

Forecasts for Consolidated Results for the Year Ending March 2018 (April 1, 2017 to March 31, 2018)

(% is in comparison to the previous year)

| Revenue | Operating profit | Ordinary profit | Net income attributable to shareholders of parent company | Net income per share | |||||

|---|---|---|---|---|---|---|---|---|---|

| (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (yen) | |

| Full Year | 300,000 | 2.5 | 20,000 | 1.6 | 19,400 | (1.6) | 13,000 | 7.4 | 151.24 |

(Note) Revised from most recently released earnings forecast: Yes

*In light of the current environment influencing our Group, in our Fiscal 2017 Third Quarter Summary of the Operating Result released on February 7, 2018, we revised the earnings forecasts previously released on May 9, 2017.

*Explanation and other notes regarding appropriate utilization of the predictions

The forecasts above have been made based on assumptions deemed rational together with information available at the time of this announcement, and the actual results may differ from these forecasts due to various factors.

More Detail

Q3/FY2017 Supplemental IR information (319KB)

End of report