Risk Management System

Material Issue

GRC

Management information

Relevance to our business

The Fuji Oil Group operates four business segments — vegetable oils and fats, industrial chocolate, emulsified and fermented ingredients, and soy-based ingredients — covering Japan, the Americas, Europe, Southeast Asia, and China. The Group’s value chain is exposed to a wide range of potential risks, including impacts on numerous fronts arising from changes in social issues, international relations and economic environments.

Basic approach

The Fuji Oil Group has selected 12 items as significant risks that need to be managed. We designated Chief Officers and formulated response plans for each of these risks. In addition, we created a framework for reporting and monitoring the status of our risk responses to the Board of Directors.

| Significant Group-wide Risks in FY2023* | |

|---|---|

| 1 | Risks related to fluctuations in raw material prices |

| 2 | Financial and tax risk |

| 3 | Legal and compliance risk |

| 4 | Management risk of Group companies |

| 5 | Risks related to food safety |

| 6 | Supply chain-related risk |

| 7 | Risks related to disasters, accidents, and infectious diseases |

| 8 | Information system and security-related risk |

| 9 | Risks related to human resource hiring and development |

| 10 | Business transformation and reform-related risk |

| 11 | Environmental and human rights risks |

| 12 | Country risks of regions connected to Group operations |

-

* The identified significant Group-wide risks

https://www.fujioilholdings.com/en/ir/policies_and_systems/risk/

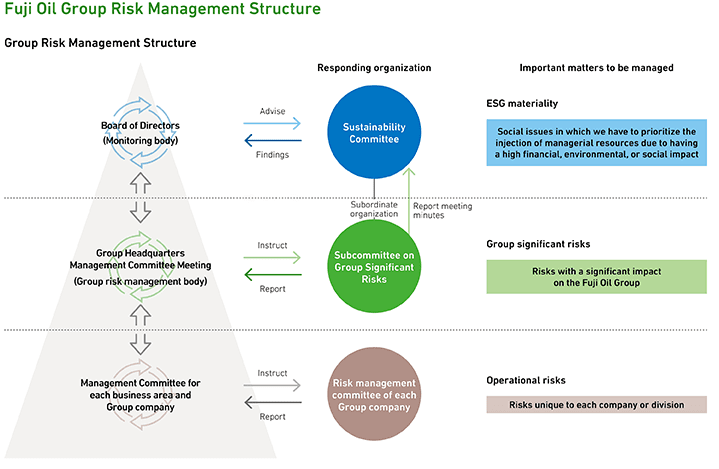

Management system

The Fuji Oil Group has positioned the Management Committee Meeting as its Group-wide risk management body. The committee uses a variety of information sources that account for the circumstances surrounding the Group — such as risks perceived by management, ESG materiality map and the risk maps of each regional headquarters and Group companies — to comprehensively determine the degree of impact on our business, and the likelihood and timing of manifestation. We then select risks that are significant to the entire Group and establish a Group-wide risk management system to plan, implement, check the progress of, evaluate and improve overall risk response measures.

Each regional headquarters and Group company creates a risk map and identifies their specific operational risks. At the same time, Fuji Oil Holdings Inc. determines strategic and financial risks through the Management Committee Meeting. After comprehensively identifying all the risks through these measures, the Board of Directors decides which risks are of particular significance. The Subcommittee on Group Significant Risks, established in FY2022 under the Sustainability Committee,*1 uses the members’ diverse perspectives to review these particularly significant risks and assess the appropriateness of responsive measures to aid in further mitigating risks that could damage the Group’s corporate value.

For each particularly significant risk identified through the abovementioned process, a Chief Officer is designated and response measures are established. In addition, the ESG Representative in charge of risk management supervises the monitoring of these risks and reports regularly to the Board of Directors.

The risk management system is overseen by the Fuji Oil Holdings ESG Representative. The Sustainability Committee, an advisory body to the Board of Directors, monitors the progress and results of initiatives as a material ESG issue.*2

Goals / Results

At least 90% complete At least 60% complete Less than 60% complete

| FY2022 Goals | FY2022 Results | Self-assessment |

|---|---|---|

| Strengthen risk management in the Fuji Oil Group |

|

|

| Properly disclose information on the financial implications of climate-related risks based on the TCFD recommendations |

|

|

| Prepare to comply with TNFD disclosures |

|

Analysis

The significant Group-wide risk items selected were discussed at the Subcommittee on Group Significant Risks and the risk management meetings with each regional headquarters and Group companies that were held on the basis of the new risk assessments. Action was then promoted to help strengthen risk management throughout the entire Group.

For our TCFD disclosure, we made it more accurate, timely and relevant by gathering pertinent information and holding discussions with the related divisions in order to specify the timing, duration and degree of impact of each risk and opportunity for each scenario. Our efforts were lauded by the Financial Services Agency in their FY2022 edition of the reference casebook of good practices on the disclosure of narrative information, which included us in the section on “Examples of Corporate Sustainability Information Disclosure in Securities Reports: Environment (Climate Change, etc.)."*

We are also collecting a variety of information and identifying biodiversity issues within the Group’s business in preparation ahead of the release of the formal TNFD disclosure framework.

Significant Group-wide risk items and TCFD information disclosure items are managed appropriately by the Chief Officer, who reports their statuses in a timely manner to the Management Committee Meeting (our Group-wide risk management body) and Board of Directors (our monitoring body) for approval.

Next step

We recognize that properly managing risks using the PDCA method and disclosing relevant information are crucial to creating a functioning risk management system and to making a risk-proof, trusted company, which is an integral part of society. To address these issues, we set the following goals for FY2023.

- Strengthen risk management in the Fuji Oil Group

- Properly disclose information on the financial implications of climate-related risks based on the TCFD recommendations

- Prepare for appropriate information disclosure regarding biodiversity based on the TNFD framework

Specific initiatives

Risk management method adopted by each Group company

PDCA

The Fuji Oil Group clearly defined the roles of Fuji Oil Holdings Inc., companies acting as regional headquarters and Group companies, and established a Risk Management Committee at each company. The Risk Management Committee takes the lead in managing the risks at each Group company by implementing the PDCA cycle, going from assessing risks (Plan), implementing countermeasures (Do), conducting self-checks (Check), and to making improvements and developing a plan for the next fiscal year (Act). It also promotes risk management through close collaboration between Fuji Oil Holdings Inc., companies acting as regional headquarters, and Group companies. In risk assessment, the Risk Management Committee of each Group company identifies all potential risks for the company and assesses them by plotting them on a risk map (vertical axis: degree of damage to/impact on the company; horizontal axis: likelihood of occurrence). Based on the assessment, the Committee specifies risks that would cause a significant degree of damage to/impact on the company as “significant risks.” It then decides on how to respond to all significant risks to mitigate their potential impact.

In the event of an emergency, an Emergency Headquarters will be established based on the Risk Management Committee, which promotes risk management activities in ordinary times, so that we can respond to the emergency quickly and appropriately across the Group.

Fuji Oil Group’s risk management

Business continuity plan (BCP)

In recent years, numerous natural disasters, pandemics, and rising geopolitical risks resulting from war and conflict cause damage and impact that hinder continued socioeconomic activity. As a food company, which is indispensable to daily living and serves life-critical functions, the Fuji Oil Group has a social responsibility to keep delivering products to customers even in the event of such damage or impact. To that end, a business continuity plan (BCP) is essential. We are developing our BCP and implementing initiatives under the following BCP Policy in order to ensure employee safety, minimize damage to business assets, and enable the continuation or early restoration of our core businesses.

For natural disasters, we carry out a range of measures including introducing a safety confirmation system for Group employees; safety confirmation training using the safety confirmation system and an emergency contact tree; conducting periodic disaster preparedness training for major earthquakes; and securing the continuity of information systems. To also reduce the impact of various geopolitical risks and improve the Group’s overall risk resilience, we work with relevant divisions based on the latest information received from regional headquarters and Group companies in order to construct and analyze risk scenarios from multiple perspectives and devise responses. Through activities like these, we strive to stage a rapid and appropriate first response in emergencies, ensure employee safety and business continuity, and minimize damage.

BCP Policy

- Give priority to the lives of employees and visitors.

- Prevent secondary disasters and do not disturb local communities.

- Fulfill our responsibility as a company to supply products.

Education and awareness-raising

Fuji Oil Holdings Inc. conducts risk management education and awareness-raising activities for our Group companies through regular visits, video conferences, etc. In this way, we firmly establish the risk management PDCA cycle and improve the quality of risk management at each Group company.

In FY2022, we increased preparations against supply chain disruption risks, reviewed the methodology used in our annual risk assessment of Group companies, and introduced a new risk assessment tool. This new tool identifies risks at Group companies from multiple angles, and calculates and visualizes the risk awareness level from the perspective of the relevant Group company, and the level of impact when the risk occurs. We also conducted risk management communication meetings both remotely and in person, shared the risk assessment results and promoted response measures, with the goal of raising the risk management level of regional headquarters and Group companies.

In addition, in FY2022 we continued providing training to eight employees newly posted to international assignments on the fundamentals of risk management and the risk management system of the Fuji Oil Group. Through these activities, we strive to raise our employees’ risk awareness and their sensitivity to risks.

Risk management communication meeting (Woodlands Sunny Foods Pte. Ltd.)