Risks and Opportunities

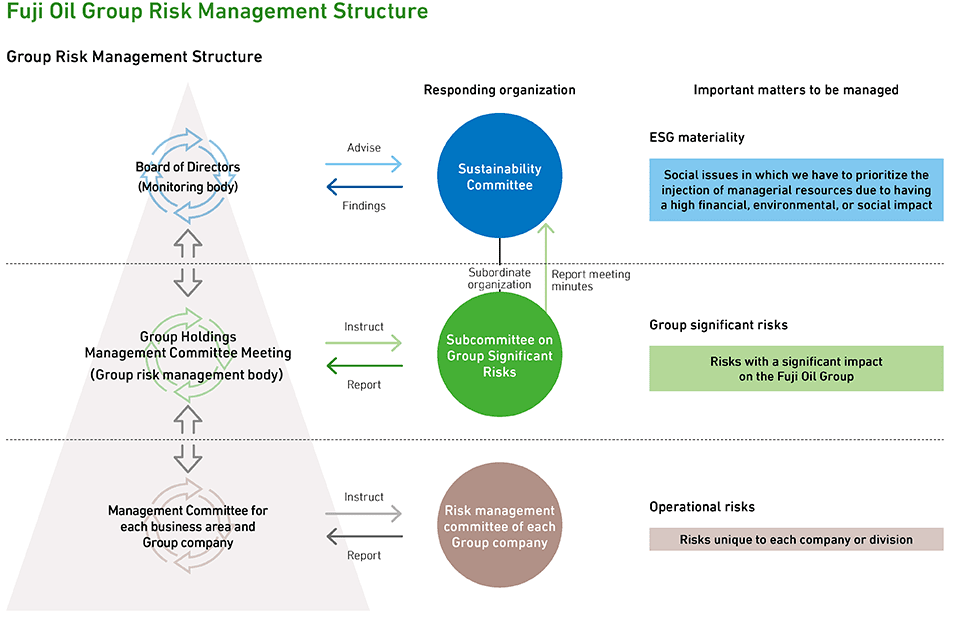

Fuji Oil Group risk management structure

The Fuji Oil Group operates its four main businesses in Japan, the Americas, Europe, Southeast Asia, and China. As such, our Group value chain is subject to various latent risks, including being impacted by social issues and changes in the economic environment. Our Group positions the Fuji Oil Holdings Management Committee as the body responsible for group-wide risk management. We use information sources that reflect the environment influencing Group operations to make a comprehensive analysis of factors such as the potential degree of impact on operations, the probability of occurrence, and the timing of manifestation. Based on this analysis, we identify group significant risks and then propose and implement response measures. We then confirm progress, evaluate efficiacy, and promote improvements to these measures. Furthermore, under the supervision of the Board of Directors, we are building a corporate risk management system to manage risks.

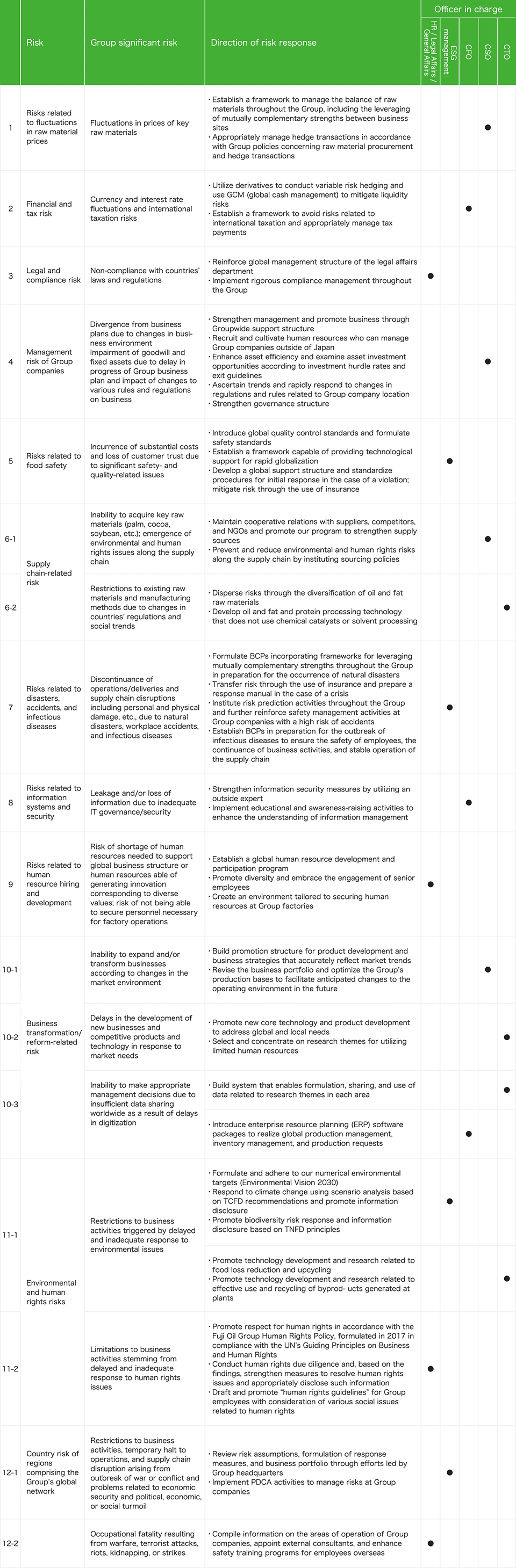

Group significant risks

- (1) Identifying group significant risks

-

Fuji Oil Holdings works to comprehensively ascertain risks, including Group strategy risks, financial risks, and ESG materiality where the “degree of impact on the Group caused by social and/or environmental issues” would be significant. The Subcommittee on Group Significant Risks evaluates and discusses these risks, after which the Group Holdings Management Committee (the Group risk management body) identifies significant risks that should be recognized and addressed on the Group level. The Management Committee further issues a report to the Board of Directors, which serves as the risk monitoring body.

Additionally, to respond to risks unique to each Group company, the Risk Management Committee of each company takes the lead on conducting risk assessments to create risk maps, which are then used to identify operational risks specific to each company. - (2) Responding to and monitoring group significant risks

-

We designate supervisors and outline response measures for identified group significant risks. To confirm the status of response measure implementation as well as the reevaluation and selection of group significant risks by the supervisors of the divisions in charge of risk management, supervisors for group significant risks issue regular reports to be confirmed by the Board of Directors, which serves as the monitoring body. To promote risk mitigation, the status of progress for issues related to each of the 12 group significant risks identified in FY2023 were discussed at Subcommittee on Group Significant Risks, and the results of these meetings were reported as necessary to the Management Committee. After the status of progress for response measures is issued to the Group Holdings Management Committee, the supervisors of group significant risk will issue reports to the Board of Directors. Furthermore, the Board is planning to confirm the causes of manifested risks and the appropriateness and timeliness of response measures.

- (3) Fuji Oil Group significant risks

-

Our group identified the following 12 significant risks that could have a significant impact on investor judgments and as requiring management. The Group has designated a risk response supervisor for each risk, and has formulated response policies. Please note that statements regarding future matters are determined to be reasonable by the Company based on information available as of March 31, 2024.