News Release

Financial results

FUJI OIL HOLDINGS

Announcement of the Settlement of Accounts for the Second Quarter of the Year Ending March 2020

2019.11.5

(Note) Figures shown have been rounded down to the nearest million yen

Our settlement of accounts for the Second quarter of the year ending March 2020 was announced on the afternoon of Tuesday, November 5 at the Tokyo Stock Exchange Press Club. An outline of the accounts is presented below.

Consolidated Results for the Second Quarter of the Year Ending March 2020 (April 1, 2019 to September 30, 2019)

Consolidated operating results (total)

(% is in comparison to the previous year)

| Revenue | Operating profit | Ordinary profit | Net income attributable to shareholders of parent company | |||||

|---|---|---|---|---|---|---|---|---|

| (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | |

| Second quarter of the year ending March 2020 | 191,585 | 30.2 | 9,050 | (4.5) | 8,252 | (13.4) | 5,979 | 36.3 |

| Second quarter of the year ending March 2019 | 147,143 | (1.7) | 9,478 | 0.9 | 9,534 | 3.5 | 4,386 | (24.4) |

- *Comprehensive income:

-

- The Second Quarter of the Year ending March 2020: 2,396 million yen -%

- The Second Quarter of the Year ending March 2019: (658) million yen (-%)

Overviews by division are as follows

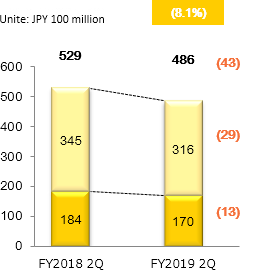

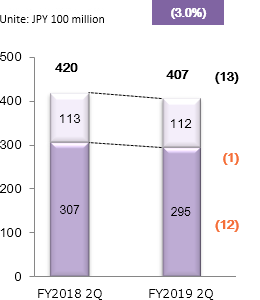

Vegetable Oils and Fats

Net sales decreased due to sales focused on profitability in Japan and overseas. Income increased on improved profitability in Japan and Europe, as well as recovery in the Americas following the stoppage of operations during the first quarter of the previous fiscal year.

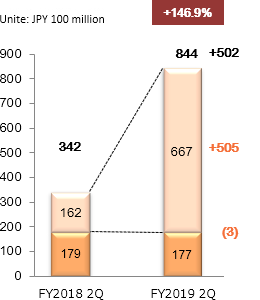

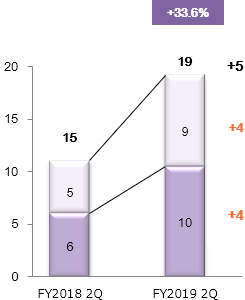

Industrial Chocolate

Net sales increased significantly. Because the consolidation of Blommer in the US contributed. Income decreased in Americas. There was a reversal of the futures evaluations in Blommer. And Brazil declined in profitability.

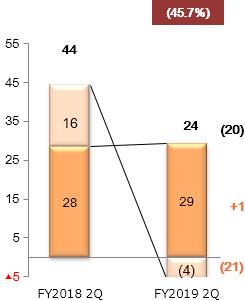

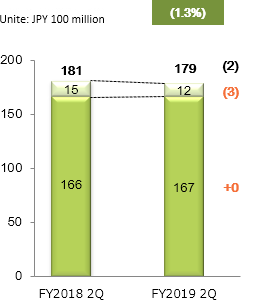

Emulsified and Fermented Ingredients

Net sales decreased due to sales volume for margarine decreased. While there was an increase in the elimination amount for unrealized gains on inventory assets, Income increased due to sales of cream and other products incased.

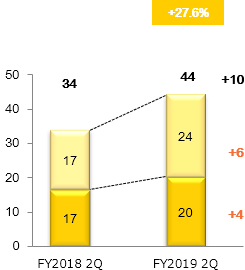

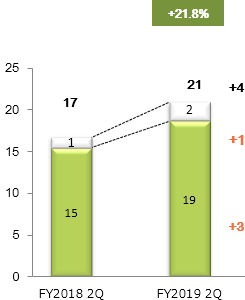

Soy-based Ingredients

Net sales decreased slightly. Although sales of soy protein foods increased favorably in Japan, overseas there was the impact from the selloff of a Chinese subsidiary last fiscal year. Income increased on higher revenues in Japan.

Forecasts for Consolidated Results for the year Ending March 2020

(% is in comparison to the previous year)

| Revenue | Operating profit | Ordinary profit | Net income attributable to shareholders of parent company | Net income per share | |||||

|---|---|---|---|---|---|---|---|---|---|

| (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (yen) | |

| Full Year | 430,000 | - | 25,500 | - | 24,000 | - | 17,000 | - | 197.77 |

*Qualitative information regarding forecast consolidated figures

At the Board of Directors Meeting held today, the Company voted to change the accounting period for our 19 overseas consolidated subsidiaries from December to March. For the current consolidated fiscal year, the transitional period during this change in accounting periods, the accounting period for overseas consolidated subsidiaries subject to the accounting period change shall be the 15-month period from January 1, 2019 to March 31, 2020. As such, we do not indicate the rate of change (%) in YoY performance.

More Detail

2Q/FY2019 IR information (579KB)

End of report