News Release

Financial results

FUJI OIL HOLDINGS

Announcement of the Settlement of Accounts for the First Quarter of the Year Ending March 2019

2018.8.7

(Note) Figures shown have been rounded down to the nearest million yen

Our settlement of accounts for the First quarter of the year ending March 2019 was announced on the afternoon of Tuesday, August 7 at the Tokyo Stock Exchange Press Club. An outline of the accounts is presented below.

Consolidated Results for the First Quarter of the Year Ending March 2019 (April 1, 2018 to June 30, 2018)

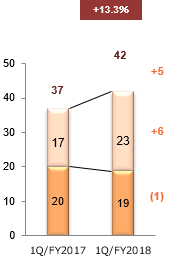

Consolidated operating results (total)

(% is in comparison to the previous year)

| Revenue | Operating profit | Ordinary profit | Net income attributable to shareholders of parent company for quarter | |||||

|---|---|---|---|---|---|---|---|---|

| (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | |

| First quarter of the year ending March 2019 | 76,434 | (1.2) | 5,826 | 7.7 | 5,734 | 7.8 | 3,486 | 3.8 |

| First quarter of the year ending March 2018 | 77,366 | 7.8 | 5,411 | 11.3 | 5,321 | 10.1 | 3,360 | 1.4 |

- *Comprehensive income:

-

- The First Quarter of the Year ending March 2019: 44 million yen (98.2%)

- The First Quarter of the Year ending March 2018: 2,512 million yen (108.3%)

Segment-specific summary

Sales strategy focused on profitability for oils and fats in Japan and confectionary and bakery ingredients in the Americas resulted in increased profits.

Overviews by division are as follows

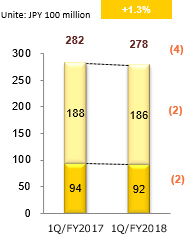

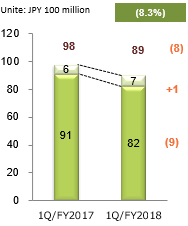

Oil and Fats Division

Domestic

Revenues decreased due to sales strategy focused on profitability for frying oils, etc.

Income increased thanks to successful sales strategies.

Overseas

Revenues decreased on factory operations shutdown due to cold climate and the impact of the weak US dollar.

Income decreased due to declining revenues in the USA.

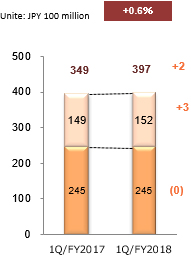

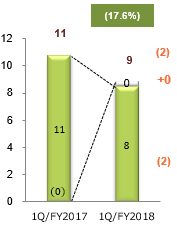

Confectionery and Bakery Ingredients

Domestic

Revenues decreased despite firm growth for chocolate, particularly on gift confectionery markets, due to stagnant sales for fillings, etc.

Income also declined slightly as sales growth for chocolate could not cover poor sales for fillings, etc.

Overseas

Revenues increased thanks to favorable sales of fillings and margarine in China covering the impact of currency fluctuations for the Brazilian real.

Income increased on factors related to consolidated adjustments related to the realization of unrealized income from inventory assets.

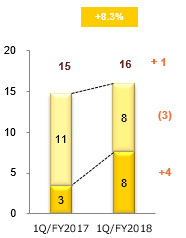

Soy

Domestic

Soy protein ingredients sales were favorable on sales for health foods and prepared processed foods but revenues decreased due to declining sales of protein foods for frozen tofu.

Income decreased due to declining sales.

Overseas

In China, revenues increased thanks to favorable sales.

Income increased thanks to improved profitability.

Forecasts for Consolidated Results for the Year Ending March 2019 (April 1, 2018 to March 31, 2019)

(% is in comparison to the previous year)

| Revenue | Operating profit | Ordinary profit | Net income attributable to shareholders of parent company | Net income per share | |||||

|---|---|---|---|---|---|---|---|---|---|

| (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (millions of yen) | (%) | (yen) | |

| First 2 Quarters (Aggregate) | 155,000 | 3.6 | 9,700 | 3.3 | 9,400 | 2.1 | 5,800 | (0.0) | 67.47 |

| Full Year | 322,000 | 4.7 | 21,300 | 4.0 | 20,700 | 3.6 | 14,000 | 1.9 | 162.87 |

*Explanation and other notes regarding appropriate utilization of the predictions

The forecasts above have been made based on assumptions deemed rational together with information available at the time of this announcement, and the actual results may differ from these forecasts due to various factors.

More Detail

1Q/FY2018 IR information (420KB)

End of report