Corporate Governance

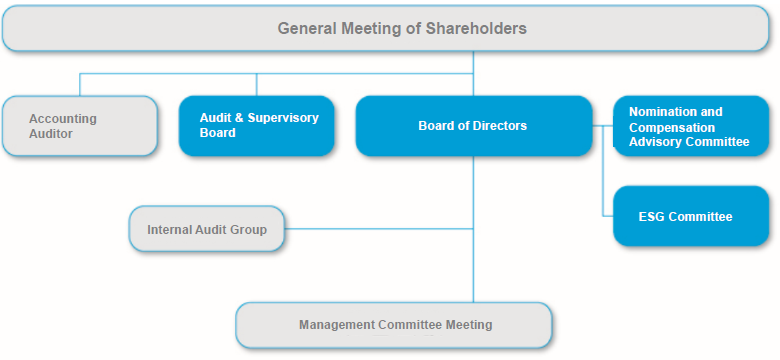

We believe that it is important for ensuring trustworthiness of shareholders to make functional and rational decision-making and business operations, as well as strengthen management oversight and supervisory functions. In order to strengthen management oversight and supervisory functions, we have appointed multiple outside directors and outside auditors, and are taking into consideration ensuring the independence of the Audit & Supervisory Board and the effectiveness of audits by auditors.

In addition, the Nomination and Compensation Advisory Committee and the ESG Committee have been established as voluntary advisory bodies to the Board of Directors. We have adopted these systems in order to improve the effectiveness of corporate governance and realize sound management with high transparency.

Fuji Oil Holdings Corporate Governance Guidelines

- Chapter 1 General Provisions

- Chapter 2 Relationship With Shareholders

- Chapter 3 Relations With Stakeholders Other Than Shareholders

- Chapter 4 Information Disclosure

- Chapter 5 Corporate Governance System

Chapter 1 General Provisions

(Purpose)

Article 1

The Fuji Oil Holdings Corporate Governance Guidelines (hereinafter, "these Guidelines") are set for the purpose of helping FUJI OIL HOLDINGS INC. (hereinafter, "the Company") achieve sustained growth and

medium- to long-term improvement of corporate value through the realization of effective corporate governance that prevents the occurrence of situations that would injure corporate value, such as violations of laws, misconduct,

or scandals.

(Definitions)

Article 2

In these Guidelines, "corporate governance" is defined as a mechanism for the Company to perform decision-making that is transparent, fair, quick, and decisive in order to meet the expectations of

stakeholders such as shareholders, customers, other business partners, officers and employees, and society.

(Basic Approach to Corporate Governance)

Article 3

The Fuji Oil Group Management Philosophy (Appendix 1) has been set as the universal approach in the Fuji Oil Group's management and positioned as the cornerstone of its corporate

activities. In order to realize the approach taken in the Fuji Oil Group Management Philosophy, strengthening and enhancing corporate governance is one of the highest management priorities, and effective corporate governance shall

be built. The Corporate Governance System Chart (Appendix) shows an overview of the Company's corporate governance system.

(Position of These Guidelines)

Article 4

These Guidelines are a guide for the Company's officers and employees to realize the Company's corporate governance.

(Revision or Repeal)

Article 5

Revision or repeal of these Guidelines shall be by decision of the Board of Directors.

Chapter 2 Relationship With Shareholders

(Ensuring Shareholder Rights)

Article 6

The Company shall appropriately take measures to substantially ensure shareholders' rights and work to maintain an environment in which shareholders can appropriately exercise those

rights.

(Respecting Voting Rights in the General Meeting of Shareholders)

Article 7

- The exercise of voting rights in the General Meeting of Shareholders is a shareholder's right, and the Company shall work as follows so that shareholders can appropriately exercise their voting rights.

- Notification of the convening of a General Meeting of Shareholders shall be sent and announced in a timely way, ensuring that shareholders have sufficient time to consider the content.

- The Company shall appropriately set the schedule related to the General Meeting of Shareholders with consideration of the perspectives of fulfillment of dialog with shareholders and provision of accurate information towards that end.

- The Company shall provide necessary information that shareholders require to make decisions in the General Meeting of Shareholders.

- The Company shall maintain an environment in which all shareholders, not just those attending the General Meeting of Shareholders, can appropriately exercise voting rights.

- When a company–proposed resolution passes with considerable opposition in the General Meeting of Shareholders, the Company shall analyze the reasons for the opposition and the causes of the large number of opposing votes and consider measures to reduce opposition to similar resolutions in future General Meetings of Shareholders.

(Protection of Shareholders' Rights)

Article 8

- For capital policy that leads to changes in or large-scale dilution of controlling interests, in order to avoid unfairly harming existing shareholders, the Company shall examine its necessity and rationality, ensure proper procedures, and appropriately disclose the content of the action to shareholders.

- When engaging in takeover defense measures, the Company shall examine their necessity and rationality, ensure proper procedures, and sufficiently explain the measures to shareholders.

- If the Company's shares are attached to a tender offer, the Company shall appropriately disclose to shareholders the Board of Directors' thinking on the offer. In addition, the Company shall not unrightfully hinder the shareholders' right to let go of shares in response to such an offer.

(Ensuring Equality Shareholders)

Article 9

Every shareholder shall be treated equally in accordance with the type and quantity of shares held.

(Prevention of Trade Contrary to the Interests of Shareholders)

Article 10

- In order to protect the interests of shareholders, the Company shall work to prevent executives or others involved with the Company from abusing their positions to engage in trade contrary to the interests of the Company and/or shareholders.

- Important or non-routine trade with Directors, Auditors, major shareholders, etc., shall require approval from the Board of Directors.

(Dialog With Shareholders)

Article 11

- In order to contribute to sustainable growth and medium- to long-term corporate value improvement, the Company shall carry out constructive dialog with shareholders to the extent and by the methods it deems appropriate.

- Policy for system development and initiatives to promote constructive dialog with shareholders shall be as follows.

- For dialog with shareholders overall, the officer in charge of the IR & Corporate Communication Division shall take control, and the IR & Corporate Communication Division shall be at the center when engaging in dialog with shareholders. It shall appropriately exchange information along with Corporate Planning, HR & Administration, Legal Affairs, and other relevant divisions.

- Directors, etc., shall handle dialog with shareholders to the extent reasonable.

- In order to enhance the means of dialog with shareholders, the Company shall periodically hold investor briefings, etc.

- Shareholders' opinions and so on raised through such dialog shall be periodically reported to the Directors, etc.

- When engaging in dialog with shareholders, insider information shall be handled appropriately in accordance with internal rules.

- In dialog with shareholders, the basic approach to capital policy shall be explained.

- In order to encourage constructive dialog with shareholders, the Company shall work to grasp its own shareholder structure.

- When setting and announcing a management plan, along with indicating basic approaches to profit planning and capital policy, the Company shall explain the content in detail by indicating targets for profitability, capital efficiency, and so on.

(Cross-shareholdings)

Article 12

- When listed shares are held as cross-shareholdings, policies related to that holding shall be disclosed.

- The Board of Directors shall perform annual verification of medium- and long-term economic rationality and future outlook for major cross-shareholdings based on factors such as risk and return. In light of that, the Board shall confirm the aims and rationality of the holdings. The policy shall be to consider timing and so on while gradually eliminating cross-shareholdings (with the exception of those whose purpose is determined to have a certain rationality).

- The exercise of voting rights relating to cross-shareholdings shall be judged from the perspective of maximizing return through improvement of long-term corporate value, without directly considering the profit on the transaction.

Chapter 3 Relations With Stakeholders Other Than Shareholders

(Good and Smooth Relations With Stakeholders Other Than Shareholders)

Article 13

- For long-term improvement of corporate value, we shall respect stakeholders such as customers, other business partners, our own officers and employees, and society, and work to maintain good and smooth relations with them.

- We shall respect the interests of stakeholders other than shareholders and smooth cooperation with them. In order to share the ideas of the Fuji Oil Group Management Philosophy throughout the entire group, we have established principles of action to be applied in all our business. We work to ensure that they are known and applied by all group officers and employees.

- We shall work in a proactive and positive manner to address sustainability issues relating to social and environmental problems.

- We shall work to promote diversity (including encouraging the participation of women) and to foster an atmosphere that values diversity as a strength.

- We shall appropriately operate internal reporting systems in order to promptly discover and correct any violations of laws or rules by the company or its officers and employees.

Chapter 4 Information Disclosure

(Information Disclosure and Transparency)

Article 14

- In order to maintain and increase the trust of stakeholders through enhanced disclosure, we shall establish a disclosure policy (Appendix 2) and disclose information important to operations voluntarily, fairly, legally, and appropriately.

- We shall disclose the following items in order to accomplish effective corporate governance.

- Management plan

- Basic thinking and basic policy on corporate governance

- Policy and procedures for deciding Director compensation

- olicy and procedures for nomination of Director and Auditor candidates

- Reasons for nomination of individual Director and Auditor candidates

- We shall work to disclose information with easily understandable content and through diverse methods that make it easy for shareholders to access.

- We shall work to disclose and provide information in English to the extent necessary from the perspective of international information disclosure.

(Accounting Auditors)

Article 15

- The Company shall work to ensure the independence of Accounting Auditors.

- Board of Auditors shall carry out the following in order to ensure proper auditing by Accounting Auditors.

- It shall set appropriate criteria for selection and evaluation of Accounting Auditors.

- It shall confirm whether Accounting Auditors have the necessary independence and expertise to perform the Company's auditing.

- The Board of Directors and the Board of Auditors shall carry out the following in order to ensure proper auditing by Accounting Auditors.

- They shall ensure that there is sufficient time to perform a high-quality audit.

- They shall provide Accounting Auditors with opportunities to obtain information from Managing Directors, etc., as necessary.

- They shall maintain a system that enables sufficient collaboration between Accounting Auditors and Auditors, internal audit departments, and Outside Directors.

- They shall maintain a system to respond if Accounting Auditors discover misconduct, etc., and ask the company for an appropriate response, or if Accounting Auditors point out deficiencies or problems.

Chapter 5 Corporate Governance System

(Board of Directors, etc. System)

Article 16

- As a company with a Board of Auditors established, the Company's Board of Directors shall appropriately exert its supervisory function, and the independently acting Auditors shall appropriately exert their auditing function. In addition, the Board of Auditors shall make resolutions to set auditing policy and increase the appropriateness and effectiveness of auditing.

- At least two of the Directors shall be appointed as independent Outside Directors (hereinafter, "Independent Outside Directors").

- The Board of Directors shall comprise diverse Directors with differing backgrounds in terms of expertise and experience and shall be maintained with the appropriate number of Directors to function effectively and efficiently.

- The Company shall establish a Nomination and Compensation Advisory Committee and an ESG Committee to supplement the functions of the Board of Directors and to advise the President & CEO.

- Nomination and Compensation Advisory Committee shall deliberate the following matters pertaining to the Company's Directors.

- Matters concerning compensation and bonuses

- Other important matters concerning compensation

- Matters concerning selection of Director candidates

- Matters concerning appointment of Directors with specific titles and representative Directors

- Other important personnel matters concerning Directors

- The ESG Committee shall be comprised of the Safety, Quality, and Environment Subcommittee, the CSR, Risk Management, and Compliance Subcommittee, and the Human Resources Development Subcommittee. The Subcommittees shall deliberate and formulate about issues related to their themes that are important to the entire Group.

(Duties of the Board of Directors)

Article 17

- In accordance with provisions of the Companies Act, the Board of Directors shall supervise the execution of the duties of Managing Directors and Executive Officers (hereinafter, "Managing and Executive Officers"), along with deciding on the execution of important business matters of the Company.

- The Board of Directors, after consideration of the agility of management decisions and the degree of specialization involved in matters to be decided, shall propose, in accordance with laws and regulations, that some resolutions of the General Meeting of Shareholders be delegated to the Board of Directors.

- The Board of Directors shall, in accordance with the provisions of laws, regulations, and internal rules, exert their management supervisory function by appropriately delegating decision-making to Managing and Executive Officers regarding business matters other than those that should be decided by the Board.

- The Board of Directors shall take, after obtaining sufficient information, faithful and deliberate care to make decisions consistent with medium- to long-term improvement of corporate value.

- The Board of Directors shall work towards the realization of Management Policy and the long term increase of both corporate and shareholder value. It shall fairly judge and respond to any action that might harm those things.

- The Board of Directors and Managing and Executive Officers shall seek mutual understanding while fulfilling their respective duties.

- The Board of Directors shall recognize that the Midterm Management Plan is a commitment to shareholders and work for improvement in order to achieve the plan's goals. The Board of Directors shall fully analyze initiatives on the Midterm Management Plan and the state of its achievement, explain its analysis to shareholders, and reflect it in future plans.

- The Board of Directors shall appropriately supervise succession plans for the Company's President, etc., based on the Management Policy and concrete management strategy.

- The Board of Directors shall maintain an environment that supports appropriate risk taking by Managing and Executive Officers.

- Regarding Managing and Executive Officers' compensation, the Board of Directors shall provide sound incentives that reflect the company's medium- to long-term performance and potential risk.

- The Board of Directors shall take highly effective supervision of Managing and Executive Officers from an independent and objective standpoint as one of its major roles and responsibilities. It shall appropriately evaluate the Company's business results and reflect that evaluation as suitable in the personnel management of Managing and Executive Officers.

- The Board of Directors shall carry out appointment and dismissal of Managing and Executive Officers through fair and transparent procedures, based on the opinions of the Nomination and Compensation Advisory Committee and its own evaluations.

- Concerning maintenance of a risk management system with internal controls regarding financial reporting, etc., the Board of Directors shall carry out the building of such a system and appropriate supervision to determine whether it is operating effectively.

- The Board of Directors shall perform annual analysis and evaluation of whether the execution of that duty is occurring in accordance with these Guidelines, and shall disclose a summary of the results.

(Chairman of the Board of Directors)

Article 18

- The Chairman of the Board of Directors shall raise the quality of the Board's deliberations and operate it in an effective and efficient manner.

- As organizer of the Board of Directors, the Chairman of the Board of Directors shall ensure constructive relations with Managing and Executive Officers and Non-Managing and Executive Officers and develop and encourage an environment that enables open discussion.

(Operation of the Board of Directors)

Article 19

- The Board of Directors shall set agendas, deliberation time, and frequency of meeting such that it is able to perform necessary and sufficient deliberation of important business execution decisions and supervision of work performance.

- So that meaningful opinions, findings, and questions can be heard in the Board of Directors' meetings, the Board shall work to send in advance materials and explanations regarding matters for deliberation and proposed resolutions to attendees so they have enough time to prepare.

- The Board of Directors shall decide in advance its annual schedule, expected matters for deliberation, and proposed resolutions.

- The minutes of Board of Directors meetings shall record the numbers of votes for and against resolutions, details of the opposing opinions of Directors voting against resolutions, and details of resolutions passed by the Board of Directors.

(Directors)

Article 20

- Directors shall supervise the business execution of Managing and Executive Officers as Members of the Board of Directors.

- Along with gathering sufficient information to perform their duties, in Board meetings, Directors shall seek explanations, express opinions positively to debate thoroughly, and exercise voting rights. In addition to receiving reports from internal audit departments, Directors shall obtain advice from outside experts when necessary.

- Directors shall have the right to propose agenda items for Board of Directors' meetings and the right to request the convening of a Board of Directors meeting. Through timely and appropriate exercise of those rights, Directors can try to solve the Company's business issues of which they become aware.

- In order to gain the confidence of shareholders, Directors shall exert their expected abilities and spend sufficient time to perform their duties as Directors.

- Directors and Executive Officers shall recognize their own fiduciary responsibilities to shareholders, always ensure appropriate cooperation with stakeholders, and act for the mutual benefit of the Company and shareholders.

(Auditors)

Article 21

- As an independent organ with the authority to investigate operations and assets, the Auditors shall examine the performance of duties by Directors. In addition, Auditors shall recognize their own fiduciary responsibilities to shareholders, always ensure appropriate cooperation with stakeholders, ensure the Company's sound and sustained growth, and work to establish a good corporate governance system that can earn the trust of society.

- Auditors shall follow auditing policy and division of auditing duties set by the Board of Auditors, attend important Company meetings such as Board of Directors' meetings, receive reports on the state of the execution of duties by Directors and others. Furthermore, they shall view important decision related documents, communicate with internal audit departments and subsidiaries, and receive reports from Accounting Auditors. By doing those things, they shall audit the performance of the Company's Directors. In addition, Auditors shall actively and positively exercise their rights in important meetings such as Board of Directors' meeting, appropriately expressing opinions to the Directors when they deem it necessary.

- Auditors shall investigate important facts, such as whether there is misconduct or violation of the law or the company's articles of incorporation in the execution of the Directors' duties.

- Auditors shall perform auditing regarding the state of development and operation of the system to ensure the appropriateness of company operations (hereinafter, "internal controls system"), including internal controls related to financial reports.

- Auditors shall gather information necessary to the performance of their duties by communicating with the Company's Directors and Accounting Auditors and by working to cooperate with other auditors and departments in charge of internal auditing and internal controls.

(Outside Directors)

Article 22

- Outside Directors and External Statutory Auditors (hereinafter, "Outside Directors") shall offer advice based on their own knowledge, from the perspective of promoting the Company's sustained growth and improving its medium- to long-term corporate value.

- From a position independent from Managing and Executive Officers and controlling shareholders, Outside Directors shall appropriately reflect the opinions of stakeholders including minority shareholders to the Board of Directors.

- Outside Directors shall offer advice from the perspectives of further increasing the fairness of decisions and actions by the Board of Directors and the Board of Auditors and of realizing best corporate governance.

- Regarding matters concerning the Company's corporate governance and business, Outside Directors shall attempt to exchange information and share understanding based an independent and objective perspective.

- Not limited to matters that arise in Board of Directors' meetings, if Outside Directors become aware through information they obtained on their own of suspicions of illegal activity, they shall cooperate with other Non-Managing and Executive Officers, including Auditors, investigate, and prevent illegal or improper business execution by speaking their opinions at Board of Directors' meetings and so on.

- Regarding important matters of business execution, Outside Directors shall use their knowledge and experience from inside and outside the Company to address risks including the inevitable conflicts of interest that arise in business execution and offer candid opinions from an outsider's perspective for the sake of sustained growth and improvement of medium- to long-term corporate value.

- Outside Directors shall secure sufficient time to perform their duties with a full understanding of their own expectations for their roles.

(Support System and Training Policy for Directors and Auditors)

Article 23

- The Company shall maintain necessary and sufficient internal systems for Directors and Auditors to effectively fulfill their roles and responsibilities.

- Directors and Auditors shall be provided with opportunities necessary to fulfill their expected role, such as provision at the time of appointment and on an ongoing basis thereafter of information and knowledge about business activities that are required in order to supervise management.

- The Company shall construct a system to share sufficient internal information with Outside Directors.

- Along with encouraging Outside Directors to understand the Company's Management Policy and corporate culture, the Company shall share information about the management environment, etc., on an ongoing basis.

- The Company shall maintain an environment in which Outside Directors have periodic meetings with Managing and Executive Officers and other Non-Managing and Executive Officers, share information among Executive officers, and exchange opinions with them.

- The Company shall bear necessary expenses for Outside Directors to fulfill that role.

(Selection Criteria, etc., for Director Candidates and Auditor Candidates)

Article 24

- In order to ensure overall balance and diversity of knowledge, experience, and abilities among Directors, selection criteria and procedures for Director candidates (Appendix 3) shall be set and disclosed.

- Selection criteria and procedures for Auditor candidates (Appendix 4) shall be set and disclosed. At least one Member with appropriate finance and accounting knowledge shall be appointed to the Auditor.

- The criteria for the independence of Outside Directors shall in principle meet the requirements for independence as set by financial instruments exchanges where the Company is listed.

(Compensation, etc., of Directors and Auditors)

Article 25

- Compensation of Directors shall be an amount within a scale resolved by the General Meeting of Shareholders. The Nomination and Compensation Advisory Committee shall deliberate fairly and transparently, and it shall be decided by the Board of Directors.

- Compensation of Auditors shall be a separate system from compensation of Directors. It shall be an amount within a scale resolved by the General Meeting of Shareholders, and the Board of Auditors shall decide it through consultation.

- Compensation of Directors (excepting Outside Directors) shall be commensurate with Directors who can sufficiently perform management supervisory functions, with a certain percentage linked to medium- to long-term business results.

(Internal Controls)

Article 26

- In order to adhere to sound management, the Company shall develop an internal controls system based on the Companies Act, etc.

(Internal Reporting System)

Article 27

- Based on the Principles in the Fuji Oil Group Management Philosophy, the Company shall set up internal reporting contacts with the aim of strengthening compliance and contributing to the Group's development by setting up an appropriate mechanism for employees and others to report illegal activities and so on to work for early detection and correction of wrongdoing.

- The internal reporting contacts shall be as follows. A contact outside the company shall be set up for Group companies in Japan with an internal contact and an attorney in charge. In each area outside Japan, contacts (to be known as "Helplines") shall be set up in each country's language(s) by Certified Fraud Examiners (CFEs).

- A system shall be maintained such that when there is an internal report, the details shall be reported to Outside Directors, who shall be able to fully exert their supervisory function.

(Enactment date and revision history)

1. Fuji Oil Holdings Corporate Governance Guidelines First Edition enacted November 6, 2015

[Appendix 1] Fuji Oil Group Management Philosophy (Summary)

Accepting the spirit that Fuji Oil has valued over the years, we have codified the mission, vision, values to be held when acting, and principles of action of the Fuji Oil Group's officers and employees as the Fuji Oil Group Management Philosophy. This Management Philosophy is an effort to share the values of all Group employees and it is the foundation of Group governance, the cornerstone of our priority criteria for decisions and actions. We believe that understanding the spirit of this Management Philosophy and following it towards the realization of our mission as we carry out our daily duties will pave the way to the future of the Fuji Oil Group and become the foundation for us to fulfill our corporate social responsibility.

< Mission = Our Reason for being >

The Fuji Oil Group seeks to develop the potential of food ingredients. We will contribute to the happiness and well-being of the people by offering delicious and healthy food.

< Vision >

We seek to contribute to the society by creating the future of delicious and healthy foods using our core technologies in oils & fats and soy.

< Values = The values that inform our actions >

- Safety, quality, and the environment

- Work for people

- Challenge and innovation

- Speed and timing

< Our Principles >

- We will comply with the laws and regulations of the society and continue to keep high ethical standards.

- We will make the safety and security of foods our highest priority and provide quality products and services.

- We will conduct environment friendly activities.

- We will value communication with our customers and provide new values.

- We will respect our valued partners and engage in fair and righteous transactions.

- We will continue to innovate with a pioneering spirit.

- We will improve our production activities through the “principle of three realities” and cost reductions.

- As employees, we will value the following items.

- We will respect the diversity and individuality of Fuji Oil Group employees.

- The Fuji Oil Group will provide opportunities of education for the growth of employees.

- We will enjoy our work with a sense of speed and passion as professionals.

- We will strive to build personal character with a spirit of harmony and dedication to the company.

- We will keep daily maintenance and improve the health and safety of our workplace.

- We will engage in corporate activities rooted in our communities and actively contribute to society.

- We will disclose accurate management information to our shareholders in appropriate and timely manner.

- We will protect and manage the company's assets and information.

- We will strictly separate the official business and private matters.

- We will understand and follow the spirit of these principles and continue to pursue the realization of our company mission.

[Appendix 2] Disclosure Policy

- Disclosure of Important Information

Regarding disclosure of important information (Note), the Company strictly obeys the Financial Instruments and Exchange Act, other relevant laws and regulations, and the rules of financial instruments exchanges, to disclose it appropriately at suitable times to shareholders, investors, and others. - Voluntary Information Disclosure

In addition to the disclosure of important information, the Company strives for full voluntary disclosure of financial composition, management policy, business strategy, and so on, so that customers, shareholders, investors, and others can make decisions based accurate understanding of the Company's condition. - Fair Information Disclosure

When performing the above information disclosure, the Company takes care to avoid selective disclosure to specified entities and works to achieve fair information disclosure. - Development of Internal Systems

The Company works to develop and improve internal systems to enable appropriate performance of the above information disclosure. - Silent Period

In order to prevent the leak of financial or other information that could affect share prices, the Company maintains a "silent period" from one day after the closing date until the earnings announcement date. During this period, the Company refrains from answering questions or commenting about financial results. However, in the event that it becomes clear during the silent period that financial results are expected to be far off previous projections, the Company will work to follow disclosure rules and make an appropriate announcement.

- "Important information" refers to company information on important decisions or events occurring in the Company or its subsidiaries that are required to be disclosed under stipulations in the Financial Instruments and Exchange Act, relevant rules set by financial instruments exchanges where securities are listed, or other laws and rules.

[Appendix 3] Selection Criteria for Director Candidates

(Role of the Board of Directors)

Article 1

- The Company's Board of Directors supervises the work of the Executive Officers and Directors based on the spirit of the Fuji Oil Group Management Philosophy that indicates the Fuji Oil Group's Management Policy in order to fulfill the mission of, "The Fuji Oil Group seeks to develop the potential of food ingredients. We will contribute to the happiness and well-being of the people by offering delicious and healthy food" and realize the vision of "We seek to contribute to the society by creating the future of delicious and healthy foods using our core technologies in oils & fats and soy."

(Scale and Configuration of the Board of Directors)

Article 2

- The Board of Directors maintains appropriate numbers for effective deliberations, and Director candidates are selected with consideration of the Board's overall high level of expertise and diversity.

- At least two of the Directors are appointed as independent Outside Directors.

(Basic Policy on Selection of Director Candidates)

Article 3

- Based on the Management Policy in Article 1, the Company selects as Director candidates people who embody those values at a high level, possess rich real-world experience and great ability, are insightful, and can be expected to contribute to the further development of the Fuji Oil Group.

(Criteria for Selection of Outside Director Candidates)

Article 4

Based on the basic policy in the previous article, Outside Director candidates are to satisfy the following requirements.

- They have filled a leadership role in a field such as company management, law, finance and accounting, education, or research and development and possess abundant experience and specialist knowledge.

- They are deeply interested in the Company's business, take a bird's eye view of its overall operations to grasp the essence of the challenges it faces, have the ability to appropriately express their opinions to management at the right time, and can lead and supervise.

(Criteria for Selection of Inside Director Candidates)

Article 5

- Based on the basic policy in Article 3, the Board of Directors selects Inside Director candidates in accordance with the opinions and views of its advisory organ, the Nomination and Compensation Advisory Committee.

(Disqualification of Director Candidates)

Article 6

Despite the provisions of Article 3, Director candidates shall not possess the following disqualifying characteristics.

- Are found to have a relationship with anti-social forces

- Are found to have violated laws or company rules on the job or to have violated laws in a private matter

(Criteria for Reappointment or Dismissal of Directors)

Article 7

- For reappointment, in addition to the above criteria, performance and contribution to management during the term as a Company Director will also be considered.

[Appendix 4] Selection Criteria for Auditor candidates

(Role and Responsibilities of Auditors)

Article 1

- Auditors audit the business execution of Directors. Auditors prevent in advance violations in business operations of laws, regulations, or the Company's articles of incorporation. Along with living up to their mandate from shareholders and the demands of society, they work to maintain and improve the Company and the Fuji Oil Group's sound management and social trust.

(Number of Members in Board of Auditors, etc.)

Article 2

- The company will have at least three Auditors.

- At least one person with appropriate finance and accounting knowledge shall be selected for the Board of Auditors.

(Basic Policy and Appointment Criteria for Selection of Auditor Candidates)

Article 3

The Company will select as Auditor candidates people who embody at a high level the role and responsibilities of Auditors as stipulated

in Article 1 and who satisfy the following requirements.

- They are deeply interested in the Company's business, can audit it from a neutral and objective perspective, and are able to contribute to ensuring sound operation.

- Standing Statutory Auditor candidates will have a deep understanding of the Company's work and possess abundant experience and great knowledge in a field such as auditing, finance, or accounting.

- External Statutory Auditor candidates shall have filled a leadership role in a field such as company management, law, finance and accounting, education, or research and development and possess abundant experience and specialist knowledge.

- External Statutory Auditor candidates shall meet the requirements for independence set by the Company.

(Disqualification of Auditor Candidates)

Article 4

Despite the previous articles, Auditor candidates shall not possess the following disqualifying characteristics.

- Are found to have a relationship with anti-social forces

- Are found to have violated laws or company rules on the job or to have violated laws in a private matter

(Criteria for Reappointment of Auditors)

Article 5

- If selected as a candidate for reappointment as a Company Auditor, in addition to the above criteria, job performance and so on during the term as Company Auditors will also be considered.

Fuji Oil Holdings Corporate Governance Guidelines

Corporate Governance Structure

(As of June 23.2021)