Corporate Governance

Material Issue

GRC

Management information

Relevance to our business

Aside from making proper judgments and acting timely and decisively on each business decision, the Fuji Oil Group monitors the direction of our business and the appropriateness of our operations in a timely manner. We do this to respond to the expectations and demands of society and stakeholders, and to keep further improving our corporate value. Our stakeholders include shareholders, investors, customers and business partners. Corporate governance is the practice of creating a system and actually running the system for that purpose. We believe that it is crucial to constantly improve this system in order for the Group's business to develop steadily and continuously.

Basic approach

The Group aims to prevent situations that would harm corporate value, such as violation of laws and regulations, fraud and misconduct. We position corporate governance as an important mechanism for ensuring timely and decisive decision-making process and business operations.

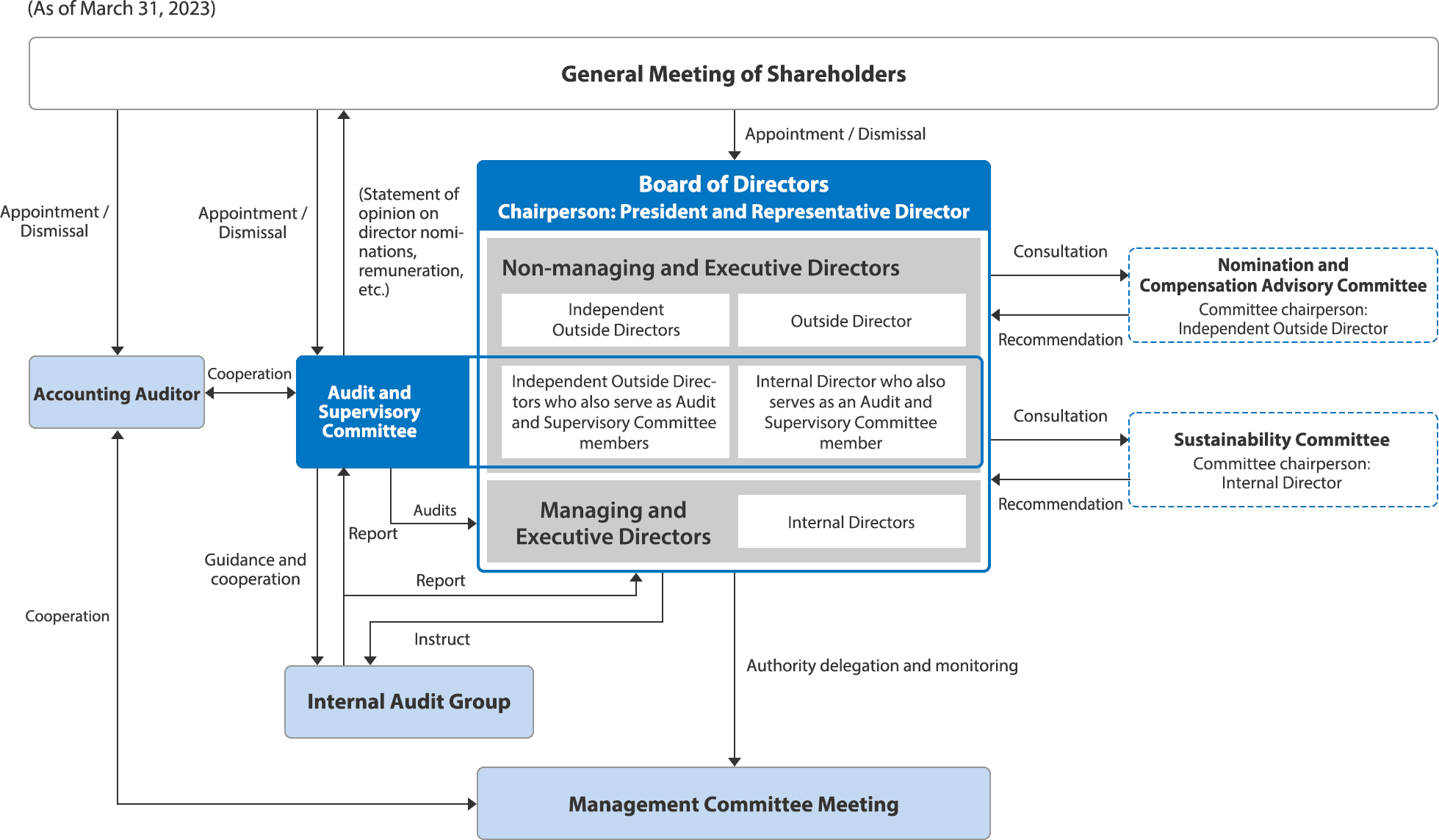

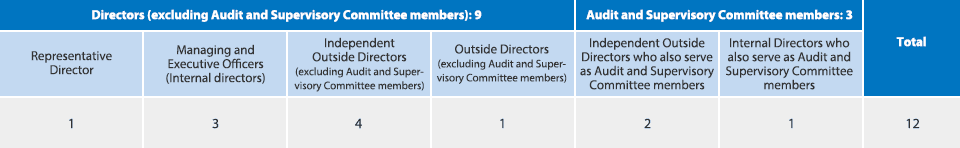

In June 2022, Fuji Oil Holdings Inc. shifted from a company with a Board of Corporate Auditors to a company with an Audit and Supervisory Committee, with the goal of further strengthening corporate governance. Under the new Board of Directors system, we plan to further strengthen the audit and supervisory functions of the Board of Directors as well as promote the separation of audit and supervisory functions from business operations in order to enable faster management decision-making.

Corporate governance structure

Board composition

Management system

On the Board of Directors, a Board Secretariat has been set under the Chief Strategy Officer (CSO) and is responsible for administrating the Board of Directors. By keeping both the Secretariat of the Board of Directors and the Secretariat of the Management Committee under the supervision of the CSO, we aim to promote interconnection between both meetings (to accurately reflect the requests and instructions from the Board of Directors in the business execution, among others), and enhance corporate governance from the perspectives of both execution and monitoring.

The Secretariat communicates and coordinates with relevant functions and business divisions within the company, or considers the recommendations of both internal and outside directors, to set the agenda and deliberations of the Board of Directors meetings. The Secretariat also appoints a third-party institution every year to evaluate the effectiveness of the Board of Directors through questionnaires and interviews with directors, and provides the results as feedback to the Board of Directors. In response to this feedback, the Board of Directors deliberates on essential matters to enhance corporate value. These matters are then reflected in the annual agendas of both the Board of Directors and the Management Committee Meetings to stimulate discussions that will facilitate management for business execution. Through constant monitoring of the matters discussed by the Management Committee Meeting, the Board of Directors ensures that their directives are properly carried out on the executive side and strives to enhance corporate governance.

The Sustainability Committee*1 and the Nomination and Compensation Advisory Committee*2 were established as advisory bodies to the Board of Directors. The Sustainability Committee deliberates on issues material to the Fuji Oil Group to carry out sustainability management, and reports its activities and makes recommendations on material ESG issues and other matters to the Board of Directors. The Nomination and Compensation Advisory Committee is formed by a majority of independent outside directors, including its chairperson. This Committee deliberates on matters referred to it by the Board of Directors, such as the CEO succession plan, review of executive structure including CEO reappointment, and review of director remuneration KPIs from the perspective of ensuring transparency and objectivity, and makes recommendations to the Board of Directors.

Goals / Results

At least 90% complete At least 60% complete Less than 60% complete

| FY2022 Goals | FY2022 Results | Self-assessment |

|---|---|---|

| Deliberations on policies and corporate strategies from the medium- to long-term perspective |

|

|

| Corporate strategy, management resource allocation and setting of both financial and non-financial management goals |

|

|

| Strengthening group governance |

|

|

| Comprehensive management of progress and KPIs on the above, and board meeting review discussions (when plan is not achieved, analyze the cause and review recovery plan) |

|

Analysis

In the effectiveness evaluation of the Board of Directors for FY2022, we conducted interviews with CEO and the Outside Director who is the chairman of the Nomination and Compensation Advisory Committee. We also conducted a survey of all directors. To set the survey questions, the Board of Directors secretariat gathered the opinions of all directors in advance and outsourced the creation of the survey to a third-party assessment organization, which formulated a unique design that enabled the assessment of the following five items: (1) Confirming the degree of improvement in response to the issues raised in the previous fiscal year, (2) Comparison of expected changes prior to transitioning to a company with an Audit and Supervisory Committee and actual results, (3) Response to new governance requests, (4) Narrowing down of agenda items for deliberation, and (5) Operations management by the secretariat. The results of the survey indicated that since transitioning to a company with an Audit and Supervisory Committee, the company has made progress in relation to initiatives towards achieving a monitoring-based Board of Directors and strengthening group governance. Furthermore, active and open discussions are being held by the Board of Directors. The survey also indicated that the Board's focus is on improving corporate value, and that monitoring is leading to improvements in the quality of management. On the other hand, the improvement of monitoring functions is still considered to be an issue, and members share a heightened awareness that further efforts are necessary to achieve the desired state of the Board. Additionally, the following issues were indicated:

- Operational challenges

(1)Need for discussion on setting KPI that should be monitored by the Board of Directors

(2)Need for a clearer distinction between short-term and medium- to long-term problem domains

The themes requiring a medium- to long-term perspective・Progress in the execution of business strategies and allocation of management resources (including human resources) to support them

・Direction and progress of R&D (including organizational structure and investment)

- Issues related to roles and functions

(1)Designing opportunities for accountability outside of the Board of Directors to more appropriately share the management status of internal directors with outside directors

(2)Need for discussion about delegating authority related to setting KPIs to be monitored by the Board of Directors (1. 1 above)

Next step

Deliberations based on the effectiveness evaluation of the Board of Directors are not limited to a one-off meeting. We will continue monthly discussions with key themes set in a timely manner. The Group decides the annual Board of Directors agenda for the following fiscal year based on the results of Board deliberations concerning the effectiveness evaluation. In determining annual agenda themes, the Board of Directors secretariat holds discussions with the directors in charge of each theme and the Management Committee Secretariat, and designs an agenda schedule for the Board of Directors so that it is linked with the Management Committee. With the transition to a company with an Audit and Supervisory Committee, the effectiveness of the Audit and Supervisory Committee is important to improving the effectiveness of the Board of Directors. For this reason, in FY2022, as part of the Board effectiveness evaluation, we also conducted an effectiveness assessment of the Audit and Supervisory Committee. We will develop and operate a framework to effectively improve our governance as a whole by sharing assessment results with Directors who also serve as Audit and Supervisory Committee members as well as all other Directors.

-

* Refer to the following webpage and documents for details on other governance structures.

https://www.fujioilholdings.com/en/about/governance/

Corporate Governance Report (PDF, 864KB)

NOTICE OF THE 95TH ORDINARY GENERAL MEETING OF SHAREHOLDERS (PDF, 191KB)